What are digital payments?

Digital Payments are the transfer of value from one payment account to another that are made over the internet and mobile channels. They can take many forms such as a mobile phone, Point of Sale computer, social media, text or SWIFT (Society of the Worldwide Interbank Financial Telecommunication) although this is more for making secure international payments.

For a digital payment to take place, the sender must have a bank account, be registered for online banking, and have a device (phone, watch, computer, card/card reader) from which they can make the payment.

Why are they important?

Cash is no longer king and how people donate is changing. Third sector organisations need to respond to this behaviour change to ensure they

continue to receive donations and make it easy for people to donate to their cause. The change in payment methods has been swift (and accelerated further by the Covid 19 pandemic) and shows no sign of slowing, so it is important organisations act sooner rather than later.

The Charities Aid Foundation’s UK Giving Report (2021), found that only 38% of donors gave with cash in 2020, compared to 51% the previous year. As few as 7% of donors used cash in January 2021, compared to 30-40% in a typical January before the pandemic.

Types of digital payment methods

Mobile point of sales

Mobile Point Of Sale systems are devices such as tablets, smartphones or other wireless devices that use an app and a card reader to process a payment. They can be contactless or use a card reader where you insert the payment card. They give the flexibility to take your payment system to a fundraising event without the worry of how you can receive donations/take payments (beyond making sure the venue has a good Wi-Fi signal). Donors simply swipe their card using a card reader attached to your device and instantly make a donation.

This includes digital collection points, such as digital Collection Plates, an easy-to-use self-service device that collects donations via contactless or Chip & PIN. Donors can even submit a Gift Aid declaration. Dona and Goodbox are providers of such services.

Devices with biometric authentication

Biometric authentication typically use fingerprinting scanners, facial recognition, but can also extend to more advanced means such as iris recognition, and even heartbeat analysis. These are now commonplace on many phones that have digital wallets (cards stored digitally on a phone) such as Apple Pay and Google Pay, which use fingerprint or facial recognition verification to authorise a transaction.

Smart speakers

Many smart speakers such as Amazon Echo/Alexa, Google Home/Nest or the Apple HomePod enable donors to give a voice command to make an instant payment.

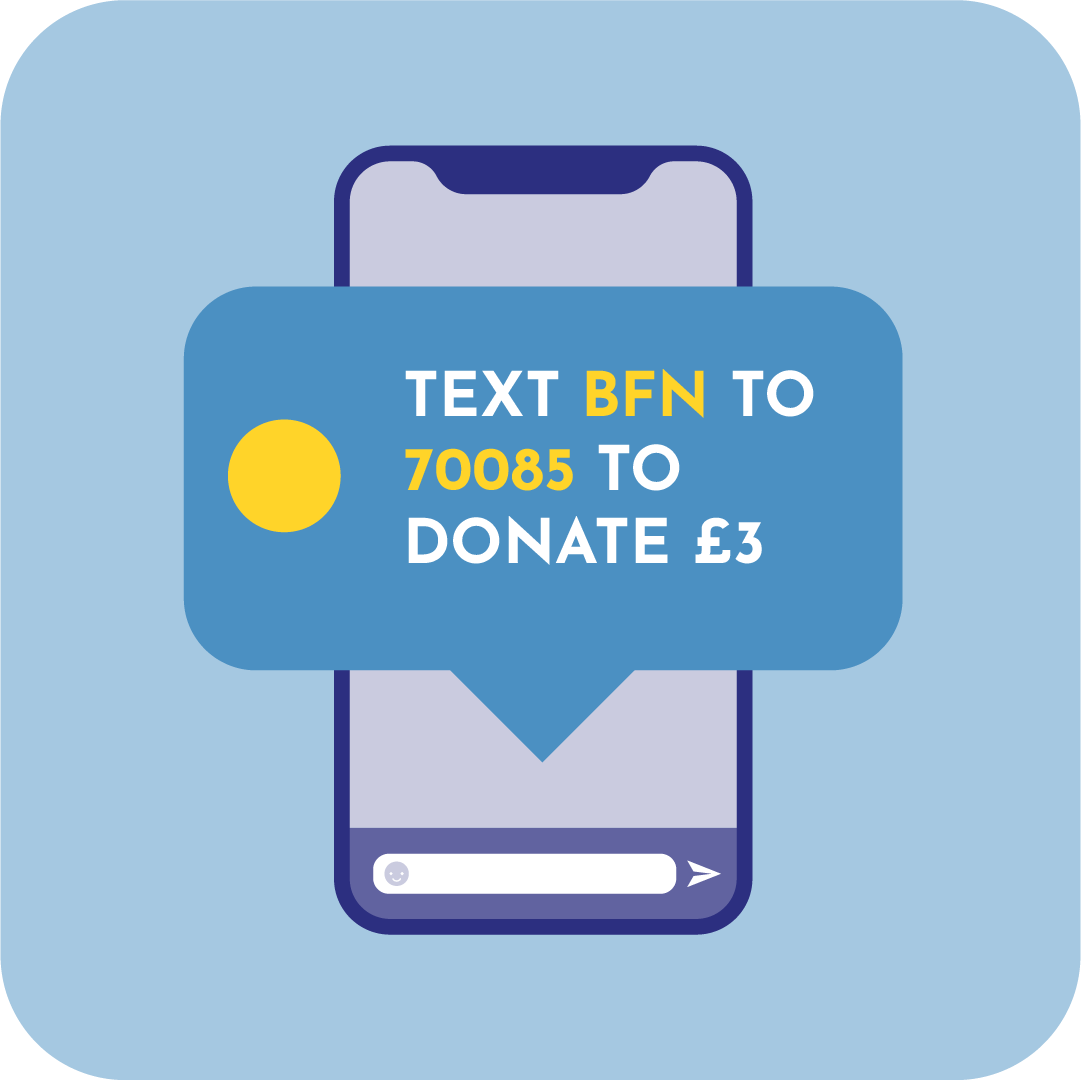

SMS – Text Donate

Text donations are now widespread, with many providers offering services, and remain popular. The most common systems are those when a donation is added to the donor’s phone bill; thus avoiding the need to enter any payment details and having the advantage of being very quick and easy to complete. The alternative system sends a message to the donor with a link where they can make a payment. Although not as quick/convenient for the donor, it does give you the opportunity to provide additional information to the donor about your organisations work with links to your website etc.

Providers include Donr, Donate and instaGiv. There is typically a charge per donation, and options to receive one-off or regular donations.

QR codes

QR codes offer a very cost-effective way for charities to utilise digital payments. They are easy and flexible to use so can be used just about anywhere from a shop window, poster, item of clothing as well as email and social media posts. Once scanned by a smartphone or tablet, the link will take the donor to a payment page where they can tap and donate. In some ways they can be seen as the modern equivalent of a fundraising bucket.

There is an added benefit of QR codes in that they are available 24/7 and cash free, so no risk of theft. A donate code can be on view in a window regardless of opening times.

Social media payment options

Having a presence on social media has become as important as having a website. It places your organisation online in the places where your donors/supporters are. However, simply having a presence online is not enough to generate income, you need to drive people towards making a donation. Many platforms enable you to simply include digital payment methods within social media sites, by adding a donate button on the sites profile page. Facebook, for example, has set up donation buttons for charities to use on their profile pages, and Instagram has a donation feature within Stories. We want making donations to be as easy as possible for our supports, and using these functions mean they do not need to leave the platform they’re on.

Small change donations

The reduction in the use of cash encourages the development of alternative collection methods to the traditional bucket at the shop checkout. There are many Apps that automatically round up pennies from purchases to the nearest pound and enable the user to donate to their chosen charity (similar Apps place the money in a savings account). There are normally some transaction fees involved.

Pledjar (Pledjar.com) is one such app to collect micro donations and is used by organisations including the Woodland Trust, Amnesty International and CPRE.

Cryptocurrency

The methods detailed so far have been traditional currency but there is a growing interest in cryptocurrencies, Bitcoin (BTC) being a familiar example. Unlike traditional currency, cryptocurrency is not linked to a government or central bank. It is instead controlled by the people using the system and not confined by international boundaries. They are also totally transparent; each unit is unique which means that transactions can be traced through the system so that a donor can see exactly what their donation is being spent on.

Although the origin of a cryptocurrency can be traced to an individual digital wallet, exactly who the wallet belongs to can be hidden, therefore it is possible that donations are being received from undesirable sources/donors.

Cryptocurrencies are underpinning by blockchain technology, this is a decentralised, shared public ledger. All sorts of assets can be recorded on blockchain whether tangible or intangible. This means that the range of donations a charity can receive has the potential to become significantly bigger as people will be able to donate both tangible and intangible assets.

In 2019, UNICEF became the first UN organisation to receive, hold, and redistribute cryptocurrency. Since then, the UNICEF CryptoFund has received eight Bitcoin (£25,000 per bitcoin as of May, 2022 value), and in 2014, the RNLI took the decision to accept Bitcoin donations to keep the service going, receiving over 20 BTC since that time.

What are the benefits of using digital payments?

- Getting more/larger donations. Donors typically give more when paying digitally, as they are not limited to the cash they are carrying when being asked to donate. It is also easy to set up recurring donations and collect gift aid through digital payments.

- More secure. Organisations will handle less cash, thus minimising opportunities for fraud and theft.

- Greater financial transparency. It is easy to see where and how much money is coming from different sources, which can inform future funding strategies.

- Donor ease. Digital payments make it very easy and convenient for donors. The process is very quick and often automated with auto fill forms or payments added to bills.

- Cost savings. Although there may be some upfront costs, these are offset by the longer-term cost efficiency savings (and benefits for reduced fraud risk) of not processing physical cash.

- Sustainability and resource benefits. Increased digital payments reduces the reliance on needing people to travel to collect and bank donations, and requires less paperwork.

Digital payment platforms

There are lots of companies offering online payment platforms for charities. Some of the more common ones being JustGiving, Enthuse, and Localgiving, which allow you to collect donations, manage fundraising campaigns and set up regular donor payments. However it is not a decision to take lightly and it is worth investing time to research options and find the one that best meets your needs -now and in the near future. Some point to consider:

What do you need from the payment platform?

Do you require something simple like one-off donation collection or more sophisticated tools and options like SMS, taking repeat payments, crowdfunding, sponsorship, community fundraising events? Also consider your future needs and how flexible the platform is to accommodate them.

How easy is it to use?

For you and the donor. Does it meet the three click rule – you should be able to perform the action you come to a site for within 3 clicks. What is the user interface like to use?

What will it cost?

You should expect to pay some fees – monthly amounts or a percentage of donations. Are the fees completely clear and transparent (again made clear to you as the organisation and to a donor?). Many providers offer price comparison – but be wary of these as they may only show the costs where they are favourable to themselves. Be prepared to do some of your own research to make sure the deal you think you are getting is genuine and there are no hidden costs.

Does it give you donor information?

A key factor in fundraising is being able to build relationships with your donors. However, not all platforms will share this information with you, especially free/low-cost platforms. These can be useful to ‘test the water’ and see how well the giving may work, but longer term you will want to have this information to follow up (within GDPR guidelines) with the donor to share information and make future appeals.

Can you control the user interface?

Are you able to brand the donation page so it maintains your corporate image? It can put off donors if the page to collect a donation looks very different from the organisation’s website/social media branding. Can you alter payment options/amounts?

Is the platform legally compliant and secure?

Most payment gateways are compliant with the Payment Card Industry Data Security Standard (PCI DSS), but it remains your responsibility to check.

Resources

For more information and ideas on digital payments, Charity Digital is a good place to start, with reviews of products and resources on topics such as fundraising ideas, reviews of online fundraising platforms and ideas on content to generate donations.

Like this post? Click below to share: